SECTION 2: Eligible Activities

This section describes the many categories of activities that may be assisted using CDBG-DR funds. It also discusses a number of ineligible activities that may not be assisted. Guidance is also provided on documenting compliance with the CDBG-DR Consolidated Notice.

Economic Revitalization

When you click on the image, it will open a new window displaying accessibility text details.

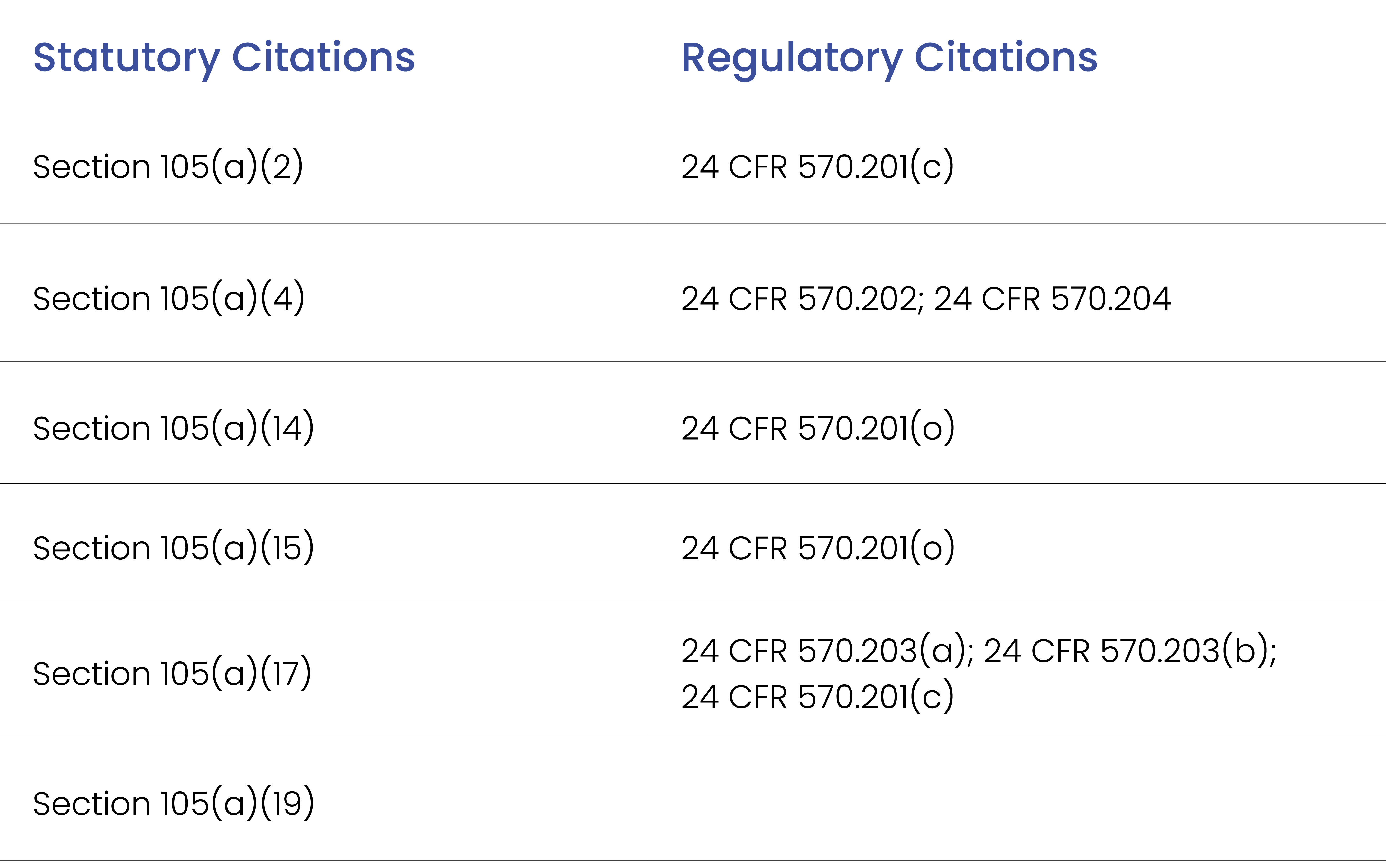

The attraction, retention, and return of businesses and jobs to a disaster-impacted area is critical to long-term recovery. Therefore, CDBG-DR activities that demonstrably restores and improves the local economy through job creation and retention are generally eligible. These activities are outlined in 24 CFR 570.203 and section 105(a)(17) of the HCDA.

Based on the U.S. Global Change Research Program’s Fourth National Climate Assessment, climate-related natural hazards, extreme events, and natural disasters disproportionately affect low- and moderate-income individuals who belong to underserved communities because they are less able to prepare for, respond to, or recover from the impacts of extreme events and natural hazards.

When funding an economic revitalization activity, grantees must prioritize those underserved communities that have been impacted by the disaster and that were economically distressed before the disaster.

All economic revitalization activities must address an economic impact(s) caused by the disaster (e.g., loss of jobs, loss of public revenue). Through its needs assessment and action plan, the grantee must clearly identify the economic loss or need resulting from the disaster, and how the proposed activities will address that loss or need. These types of activities may also address job losses, or negative impacts to tax revenues or businesses.

Examples of eligible activities include providing loans and grants to businesses, funding job training, making improvements to commercial/retail districts, and financing other efforts that attract/retain workers in devastated communities.

Working Capital

Grantees may provide many forms of assistance to businesses under the provisions of 105(a)(17) of the HCDA, including “working capital.” The prioritization of assistance to underserved communities that were economically distressed before the disaster shall apply to this activity.

In past recovery efforts, grantees have inquired as to how a business’s working capital needs should be calculated. Working capital is one facet of a business’s need after a disaster; it is not, however, the vehicle by which to fund all of a business’s unmet needs. In its simplest form, working capital is defined as “Current Assets minus Current Liabilities” on the business’s balance sheet. In other words, working capital is the amount of cash needed to fund one year’s worth of liabilities (i.e., one year’s worth of mortgage payments and other debt, tax and utilities, yearly wages, and accounts payable) after subtracting other current assets such as inventory and accounts receivable. Working capital does not include any expense for any form of construction or expansion of existing facilities, whether “hard” or “soft” costs. Therefore, grantees should not include expenses for construction or expansion of existing facilities in any calculation involving working capital, unless the grantee intends to provide a comprehensive assistance package that is subject to the environmental review requirements of 24 CFR Part 58.

The provision of working capital constitutes an economic development activity under 24 CFR 58.35(b)(4) and may provide operating costs under 24 CFR 58.35(b)(3) and therefore, per 24 CFR 55.12(c)(1), are not subject to 24 CFR part 55 unless it includes expenses for construction or expansion of existing facilities. A grantee’s environmental review record must document the determination of this exclusion from environmental review.

Underwriting

Notwithstanding section 105(e)(1) of the HCDA, no CDBG-DR funds may be provided to a for-profit entity for an economic development project under section 105(a)(17) unless such project has been evaluated and selected in accordance with guidelines developed by HUD pursuant to section 105(e)(2) for evaluating and selecting economic development projects. States and their subrecipients are required to comply with the underwriting guidelines in Appendix A to 24 CFR part 570 if they are using grant funds to provide assistance to a for-profit entity for an economic development project under section 105(a)(17) of the HCDA. The underwriting guidelines are found at Appendix A of Part 570.

CDBG–DR Funds as Match

When you click on the image, it will open a new window displaying accessibility text details.

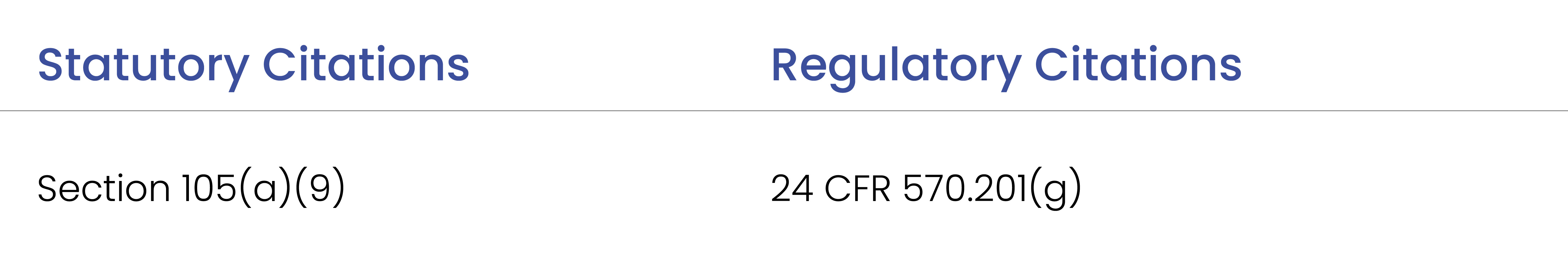

Section 105(a)(9) of the HCDA authorizes the use of CDBG-DR funds for “payment of the non-Federal share required in connection with a Federal grant-in-aid program undertaken as part of activities assisted”. This means that CDBG-DR funds can be used to satisfy the non-federal match if the use of the funds otherwise meets all CDBG-DR requirements. FEMA and HUD jointly issued guidance for the use of CDBG-DR funds as the non-federal cost share (Local Match) for FEMA’s Public Assistance program. The guidance describes baseline principles and other considerations associated with a “flexible match” framework that reduces administrative costs and promotes compliant use of CDBG-DR funds for Local Match. For example, if CDBG-DR funds are used for the non-federal share, the funds must:

-

Be a necessary expense that relates to disaster relief, long-term recovery, restoration of infrastructure and housing, and economic revitalization in the most impacted and distressed areas;

-

Meet a national objective;

-

Be CDBG-eligible or eligible through a waiver and alternative requirement;

-

Follow applicable cross-cutting requirements (i.e. section 504, ADA, Davis Bacon, etc.)

-

Follow all CDBG-DR requirement (i.e., reporting in DRGR, performance reports, procurement, etc.)

CDBG–DR appropriations acts generally include a statutory order of assistance for Federal agencies. Although the language may vary among appropriations, the statutory order of assistance typically provides that CDBG-DR funds may not be used for activities reimbursable by or for which funds are made available by FEMA or the U.S. Army Corps of Engineers.

This means that grantees must verify whether FEMA or the U.S. Army Corps of Engineers funds are available for an activity (i.e. the application period is open) or the costs are reimbursable by FEMA or the U.S. Army Corps of Engineers (i.e., the grantee will receive FEMA or the U.S. Army Corps of Engineers assistance to reimburse the costs of the activity) before awarding CDBG-DR assistance for costs of carrying out the same activity. If FEMA or the U.S. Army Corps of Engineers are accepting applications for the activity, the applicant must seek assistance from those sources before receiving CDBG-DR assistance. If the applicant’s costs for the activity will be reimbursed by FEMA or the U.S. Army Corps of Engineers, the grantee cannot provide the CDBG-DR assistance for those costs.

In the event that FEMA or the U.S. Army Corps of Engineers assistance is awarded after the CDBG– DR assistance to pay the same costs, it is the CDBG-DR grantee’s responsibility to recapture CDBG-DR assistance that duplicates assistance from FEMA or the U.S. Army Corps of Engineers.

Regardless of the funding source, ongoing communication is also important when using CDBG-DR funds for the non-federal share in an activity. Typically, the CDBG-DR grantee is a different entity from the entity requiring non-federal match. If this is the case, CDBG-DR grantees are encouraged to hold active communication with clearly assigned points of contact who oversee the other funding source to help mitigate the risk of noncompliance during the period of performance for the activity.

Federal Programs with Matching Requirements

Below are some examples of federal recovery and mitigation programs CDBG-DR funds can be used for as the non-federal share.

BRIC supports state and local communities, tribes, and territories as they undertake hazard mitigation projects, reducing the risks they face from disasters and hazard mitigation programs. Small Impoverished Communities are eligible for an increase in cost share up to 90 percent federal and 10 percent non-federal. The definition of a small, impoverished community is a community of 3,000 or fewer individuals identified by the Applicant that is economically disadvantaged, with residents having an average per capita annual income not exceeding 80 percent of the national per capita income, based on best available data.

For more information, visit FEMA’s website.

PA is a reimbursement program that provides federal funding to help communities respond to and recover from disasters. FEMA reimburses state and local governments for at least 75 percent of eligible cost for disaster-related debris removal, emergency protective measures to protect life and property, and permanent repair work to damaged or destroyed infrastructure. For more information, visit FEMA’s website.

On January 3, 2020, FEMA and HUD signed a Memorandum of Understanding (MOU) that outlines a series of actions intended to streamline the use of CDBG-DR funds to satisfy the cost-share requirements of the Public Assistance (PA) Program. This included developing a joint Implementation Guidance (Guidance) that outlines a flexible approach to using HUD CDBG-DR funding for the PA local cost-share requirements (flexible match). The flexible match concept allows CDBG-DR funding to be applied to distinct facilities or sites within a PA project. Applying the flexible match concept reduces the number of sites that must meet both FEMA PA and CDBG-DR requirements. While all the sites and facilities must comply with FEMA PA requirements, only the CDBG-DR assisted portion of the project must comply with CDBG-DR requirements.

The Guidance can be found here: Implementation Guidance for Use of CDBG-DR Funds as Non-Federal Cost Share for FEMA's PA Program.

HMGP includes long-term efforts to reduce the impact of future disasters. HMGP may fund projects for:

-

Protecting or purchasing public or private property that experienced, or is in danger of experiencing, repetitive damage;

-

Purchasing and removing a flood-prone property from an individual;

-

Developing and adopting hazard mitigation plan; and

-

Using aquifer storage and recovery, floodplain and stream restoration, flood diversion and storage, or green infrastructure methods that may reduce the impacts of flood and drought

FEMA provides up to 75 percent of the total amount of funds needed for mitigation projects. For more information, visit FEMA’s website.

A Guide on How CDBG-DR Grantees Can Meet the Requirements of the Consolidated Notice