SECTION 2: Eligible Activities

This section describes the many categories of activities that may be assisted using CDBG-DR funds. It also discusses a number of ineligible activities that may not be assisted. Guidance is also provided on documenting compliance with the CDBG-DR Consolidated Notice.

Housing and Related Floodplain Issues

When you click on the image, it will open a new window displaying accessibility text details.

Housing activities may include, but are not limited to, new construction, reconstruction, and rehabilitation of single-family or multifamily units, homeownership assistance, and acquisition and buyout.

For CDBG-DR grantees subject to the Consolidated Notice, single family housing means four units or less, and multifamily housing is five or more units.

A grantee is required to include in its action plan, a description of how the use of CDBG-DR funds will respond to its identified unmet housing needs. This description must include how the use of CDBG-DR funds for housing activities will address the identified unmet needs of public housing, affordable rental housing, housing for vulnerable populations, and other housing, including how the grantee will incorporate hazard mitigation measures and green building into its recovery efforts.

Most often, grantees use CDBG-DR funds to rehabilitate damaged homes and rental units. However, grantees may also fund new construction or rehabilitate units not damaged by the disaster if the activity clearly addresses a disaster-related impact and is located in a MID area. Grantees are also encouraged to coordinate with HUD-certified housing counseling organizations and counselors to ensure that information and services are made available to both renters and homeowners. HUD’s Office of Housing Counseling and HUD-approved Housing Counseling Agencies.

Housing Rehabilitation and Reconstruction

Rehabilitation and reconstruction of damaged housing units are the most common types of housing activities. HUD provides grantees the flexibility to design their rehabilitation and reconstruction programs in a way that best meets the needs of their residents. Grantees use the impact and unmet needs assessment in their disaster recovery action plan to define what those community needs are. Some examples of eligible types of programs and activities that may be funded include:

-

Rehabilitating existing structures, including substantial rehabilitation programs that bring the property up to local codes and standards,

-

Energy efficiency programs to improve the energy efficiency of homes through insulation, new windows and doors, and other similar improvements,

-

Handicapped accessibility programs through improvements, such as grab bars and ramps,

-

Repairs to a housing unit such as fixing a roof,

-

Demolishing and re-building a unit in substantially the same manner,

-

Grants, loans, loan guarantees, interest subsidies, and other forms of assistance to homeowners for the purpose of repairs, rehabilitation, or reconstruction.

Replacement of substantially damaged residential buildings must meet the Green and Resilient Building Standard described in the Consolidated Notice. Grantees should refer to the Environmental Review section below for more information on the appropriate building standards.

As a reminder, CDBG-DR funds can be used to acquire, rehabilitate, or construct rental housing, including affordable rental housing activities. When funding affordable rental housing activities, grantees are encouraged to use the LMI- Housing (LMH) national objective. When using the LMH national objective, these units must be rented to a low- and moderate-income person at affordable rents for the period specified.

The Consolidated Notice establishes the HOME Investment Partnerships Program (HOME) as the minimum standard for affordability. If a grantee chooses to apply another standard, the standard must meet or exceed the requirements established in HOME and must be enforceable. Examples of ways to enforce affordability periods are by using covenants and deed restrictions for the required period.

-

For rehabilitation or reconstruction of rental housing, the grantee must: define “affordable rents” and rent to LMI households at affordable rents.

-

For new construction of affordable rental housing of 5 or more units to meet the LMH national objective, the grantee must: define “affordable rents,” the enforcement mechanisms, and timeframes that will apply to the new construction of affordable rental housing. The minimum timeframes and other related requirements acceptable for compliance are the HOME Investment Partnerships Program (HOME) requirements at 24 CFR 92.252(e), including the table listing the affordability periods at the end of 24 CFR 92.252(e).

-

For the construction of new single-family units for homeownership, the grantee must: meet or exceed the applicable HOME requirements. Note, this requirement does not apply to housing units newly constructed or reconstructed for an owner-occupant to replace the owner-occupant’s home that was damaged by the disaster. The minimum affordability period acceptable for compliance are the HOME requirements at 24 CFR 92.254(a)(4). If a grantee applies other standards, the periods of affordability applied by a grantee must meet or exceed the applicable HOME requirements in 24 CFR 92.254(a)(4) and the table of affordability periods directly following that provision.

New Construction

Section 105(a) and 24 CFR 570.207(b)(3) are waived to permit new housing construction. For example, a grantee may fund the new construction of affordable housing to address a decline in affordable housing units after the disaster. All new construction buildings must meet the Green and Resilient Building Standard which is described below in the Environmental Review section. A grantee can demonstrate the need for new construction by describing the disaster’s overall effect on the quality, quantity, and affordability of the housing stock and the resulting inability of that stock to meet post-disaster needs and population demands. New housing construction activities are encouraged to meet the LMI national objective through LMH.

A grantee could do this by funding an affordable rental housing activity that is 100 percent dedicated to LMI persons or with mixed-incomes, where 51 percent or more of the units benefit LMI persons.

For new construction of homes built for LMI households that include affordability requirements, grantees should establish resale or recapture requirements and describe those requirements in the initial action plan or substantial amendment (whichever the activity is proposed in). The resale or recapture requirements must clearly describe the terms of resale or recapture and the specific circumstances under which resale or recapture will be used.

Affordability standards must be enforceable and imposed by recorded deed restrictions, covenants, or other similar mechanisms. The affordability requirements do not apply to housing units (newly constructed or reconstructed) for an owner-occupant when the grantee is replacing the owner-occupant’s home that was damaged by the disaster.

Elevation Standards

For new construction, rehabilitation of substantial damage, or rehabilitation resulting in substantial improvement of residential structures (defined at 24 CFR 55.2(b)(10)) located in an area delineated as a special flood hazard area (or equivalent in FEMA’s data sources), the elevation standards listed below apply.

-

All structures defined at 44 CFR 59.1 designed principally for residential use and located in the 1 percent annual (or 100-year): must be elevated with the lowest floor, including the basement, at least two feet above the 1 percent annual floodplain elevation.

-

Mixed-use structures with no dwelling units and no residents below two feet above base flood elevation: must be elevated or floodproofed, in accordance with FEMA floodproofing standards at 44 CFR 60.3(c)(3)(ii) or successor standard, up to at least two feet above base flood elevation.

-

All Critical Actions, as defined at 24 CFR 55.2(b)(3), within the 500-year (or 0.2 percent annual chance) floodplain: must be elevated or floodproofed (in accordance with the FEMA standards at 44 CFR 60.3(c)(2)-(3) or successor standard) -to the higher of the 500-year floodplain elevation or three feet above the 100-year floodplain elevation.

As defined in 24 CFR 55.2(b)(3), Critical Actions means any activity for which even a slight chance of flooding would be too great, because such flooding might result in loss of life, injury to persons, or damage to property. Critical Actions include activities that create, maintain, or extend the useful life of those structures or

-

Produce, use or store highly volatile, flammable, explosive, toxic or water-reactive materials;

-

Provide essential and irreplaceable records or utility or emergency services that may become lost or inoperative during flood and storm events (e.g., data storage centers, generating plants, principal utility lines, emergency operations centers including fire and police stations, and roadways providing sole egress from flood-prone areas); or

-

Are likely to contain occupants who may not be sufficiently mobile to avoid loss of life or injury during flood or storm events, e.g., persons who reside in hospitals, nursing homes, convalescent homes, intermediate care facilities, board and care facilities, and retirement service centers. Housing for independent living for the elderly is not considered a Critical Action.

Additionally, Critical Actions shall not be approved in floodways or coastal high hazard areas.

Examples of Critical Actions include hospitals, nursing homes, police stations, fire stations and principal utility lines.

Applicable State, local, and tribal codes and standards for floodplain management that exceed these requirements must be followed. Please note that grantees should review the UFAS accessibility checklist and the HUD Deeming Notice, 79 FR 29671 (May 23, 2014) to ensure that these structures comply with accessibility requirements.

As grantees review the elevation requirements found in the Consolidated Notice, HUD strongly encourages grantees to also review and consider applying elevation standards within a broader floodplain as determined in accordance with the Federal Flood Risk Management Standard (FFRMS), which was established in Executive Order 13690 in January 2015 to encourage Federal agencies to consider current and future risk when taxpayer dollars are used to build or rebuild near floodplains. HUD is one of twenty Federal agencies to discuss the implementation of the FFRMS and other flood resiliency activities as a part of the Flood Resilience Interagency Working Group (IWG). This group is focused on coordinating federal efforts on implementation of FFRMS and other flood priorities. The coordination will help to increase flood resilience and standards of safety against floods and sea level rise.

The FFRMS floodplain is the area subject to flooding as determined by the climate-informed science approach (CISA), freeboard value approach (FVA), or 0.2 percent annual chance flood approach (0.2PFA). More information on the FFRMS floodplain can be found in the Water Resource Council’s Guidelines for Implementing Executive Order 11988 and 13690.

CDBG-DR funds may be used to enhance elevation and other flood proofing requirements to standards above those required by HUD. Although HUD does not currently have regulations in place to implement FFRMS, grantees can use the climate-informed science approach (CISA), freeboard value approach (FVA), or 0.2 percent annual chance flood approach (0.2PFA) to support their development of elevation standards that are necessary and reasonable.

Buyout Activities

Buyout activities are acquisitions for the purpose of reducing risk of property damage from future hazards. Grantees may buyout properties located in the floodway, floodplain, or other Disaster Risk Reduction Area. An important distinction from a buyout and an acquisition is that a buyout is subject to land use restrictions. Once a property has been acquired through a buyout, the land can only be used as open “green” space, recreational, floodplain or wetland management, or other disaster-risk reduction practices.

New structures are not permitted on the land other than facilities that are open on all sides, a public restroom, or flood control structure.

Examples of eligible uses are a park, campground, and outdoor recreation area. If a flood control structure is located on the land after a buyout, the structure cannot reduce valley storage, increase erosive velocities, or increase flood heights on the opposite bank, upstream, or downstream.

Additionally, the local flood manager must approve the structure in writing before construction of the structure commences.

Grantees that choose to undertake a buyout program have the discretion to determine the appropriate valuation method, including paying either pre-disaster or post-disaster (fair market value). The grantee must apply its valuation method for all buyouts carried out under the program. In most cases, applying the pre-disaster valuation method provides assistance because the award amount is greater than the post-disaster value of the building.

If the grantee determines the post-disaster value of a property is higher than the pre-disaster value, a grantee may provide exceptions to its established valuation method on a case-by-case basis. The grantee must describe the process for such exceptions and how it will analyze the circumstances to permit an exception in its buyout policies and procedures. Each grantee must adopt policies and procedures on how it will demonstrate that the amount of assistance for a buyout is necessary and reasonable.

Real property acquisitions, including buyouts, undertaken with CDBG-DR funds (even if funds are used only for acquisition costs other than the purchase price) are generally subject to the requirements in URA regulations at 49 CFR part 24, subpart B, unless they satisfy an exception at 49 CFR 24.101(b)(1)–(5). For acquiring entities with eminent domain authority, the most relevant exception is commonly 49 CFR 24.101(b)(1), which requires that the acquisition satisfy a four-part test.

The Four-Part Test and Buyouts

i.With respect to the buyout of properties, an ‘‘intended, planned, or designated project area,’’ as referenced at 49 CFR 24.101(b)(1)(ii), shall be an area for which a clearly defined end use has been determined at the time that the property is acquired, in which all or substantially all of the properties within the area must be acquired within an established time period as determined by the grantee or acquiring entity for the project to move forward. Where moving forward with a project does not depend upon acquiring specific sites within established timeframes for a clearly defined end use, there is not an ‘‘intended, planned or designated project area.’’

To illustrate this point, a grantee or acquiring entity’s buyout would satisfy the criteria in 49 CFR 24.101(b)(1)(ii) with respect to the acquisition of property in the following examples:

-

A broad buyout eligibility area is identified by the need to reduce risk, but no specific property must be acquired, or

-

A clearly defined end use (i.e., more specific than the categories of open space, recreational, floodplain and wetlands management practices, or other disaster-risk reduction practices) has not been determined at the time of acquisition.

Grantees are reminded that the distinction between buyouts and other types of acquisitions is important, because grantees may only redevelop an acquired property if the property is not acquired through a buyout program (i.e., the purpose of acquisition was something other than risk reduction). When properties are not acquired through a buyout program, the purchase price must be consistent with applicable uniform cost principles (and the pre-disaster fair market value may not be used).

Geophysical (e.g. volcanos) and meteorological (e.g. wildland fires) disaster risk areas may also be identified by the grantee as Disaster Risk Reduction areas eligible for a buyout to reduce risk from future events. Grantees should take actions to promote an increase in hazard insurance coverage in these areas.

Grantees are encouraged to carry out property acquisitions as a means of acquiring contiguous parcels of land for uses compatible with wildland-urban interface management practices. To the maximum extent practicable, grantees should avoid circumstances in which parcels that could not be acquired through a buyout remain alongside parcels that have been acquired through the grantee’s buyout program.

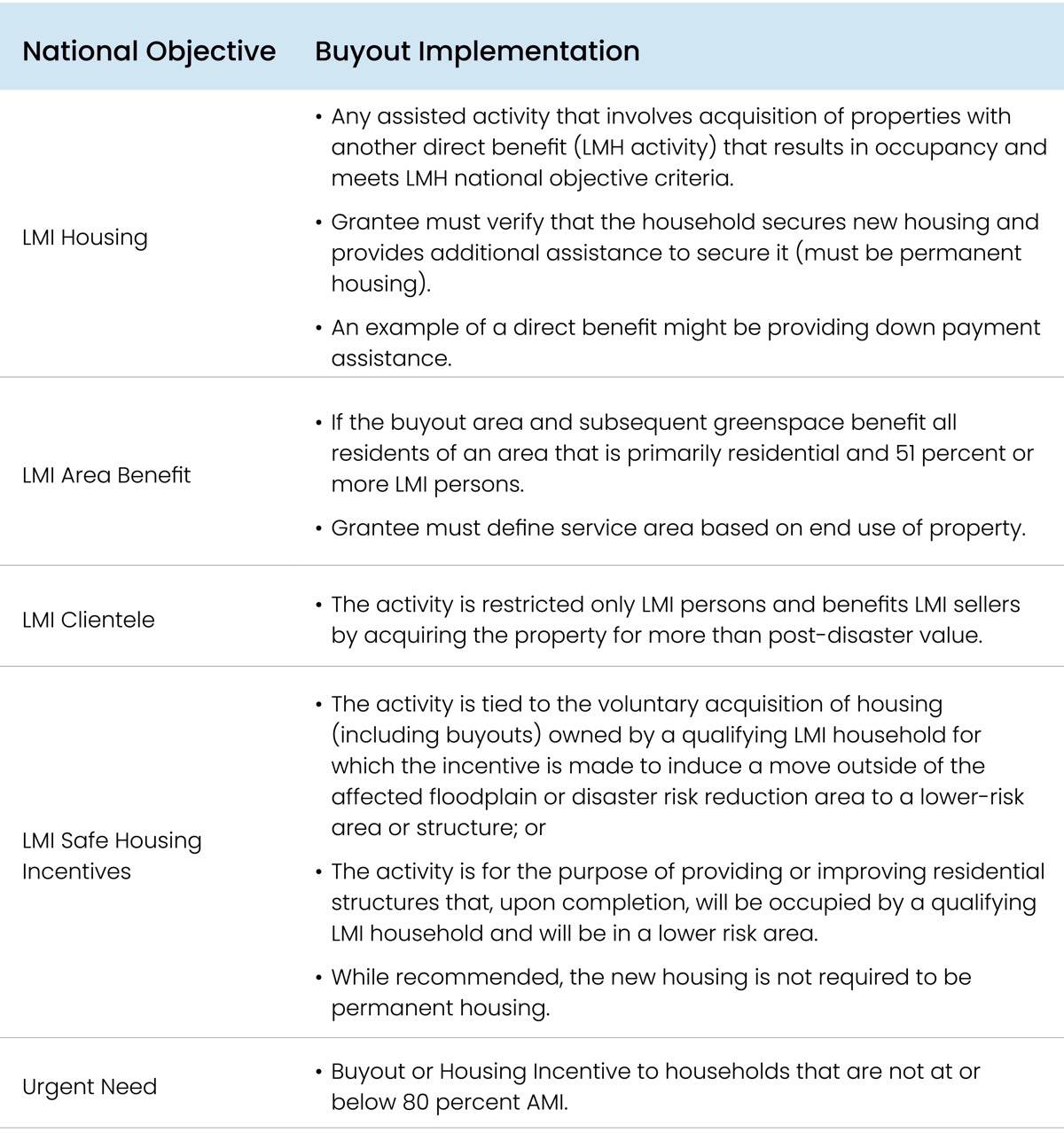

Buyout National Objectives

When designing and implementing a buyout activity, it is important grantees consider the impacts of the buyout to program beneficiaries, especially for LMI persons, vulnerable populations, and protected classes. As such, grantee should strive to use the LMH national objective when possible so that housing will, upon completion, be occupied by such persons. A buyout program that merely pays homeowners to leave their existing homes does not meet the requirements of the LMH national objective because it does not result in a LMI household occupying a residential structure. Grantees should note that a buyout program that merely pays homeowners to leave their existing homes for fair market value does not result in an LMI household occupying a residential structure and does not provide a benefit to the homeowner, and thus cannot meet the requirements of the LMH or LMC national objectives.

When you click on the image, it will open a new window displaying accessibility text details.

URA Voluntary Acquisition- Homebuyer Primary Residence Purchase

The requirement at 49 CFR 24.101(b)(2) is waived in connection with a homebuyer’s voluntary purchase and occupancy of their primary residence. This waiver reduces the burdensome administrative requirements for homeowners following a disaster. This waiver has no effect on a displaced tenant’s eligibility for URA relocation assistance as a result of the federally assisted acquisition. Grantees are reminded this waiver does not apply to agencies or entities acquiring homes on behalf of homeowners.

Homeownership Assistance

The Consolidated Notice waives 42 U.S.C. 5305(a)(24) in its entirety and creates an alternative requirement that permits the types of eligible activities at 42 U.S.C. 5305(a)(24)(A)-(E) for homeowners up to and including 120 percent AMI. The alternative requirement also permits grantees to provide up to 100 percent down payment assistance for homebuyers up to 120 percent AMI. Grantees are reminded that homeownership assistance for households above 80 percent AMI will need to use the urgent need national objective.

A Guide on How CDBG-DR Grantees Can Meet the Requirements of the Consolidated Notice